Amazon Seller Central Chargebacks Report

Comprehensive tracking and monitoring of payment card chargebacks and dispute resolution processes

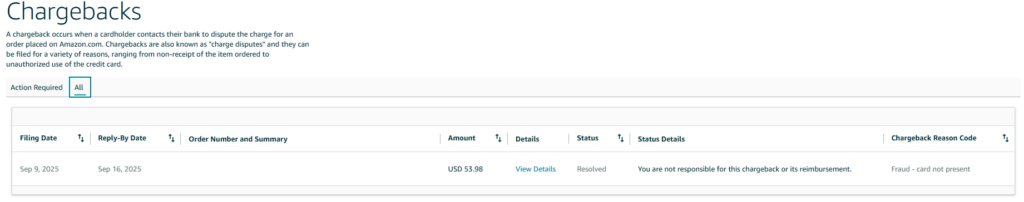

The Chargebacks Report provides complete visibility into all payment disputes filed against your Amazon transactions within the past 90+ days. This automated report captures chargeback details, reason codes, dispute status, and financial impacts for every payment card dispute. Monitoring chargebacks is essential for understanding payment risks, maintaining merchant account health, and protecting your business from fraudulent disputes.

Each chargeback record includes the complete case history, bank reason codes, representation opportunities, and resolution outcomes. Understanding chargeback patterns helps identify fraud trends, payment processing issues, and customer service gaps that lead to disputes.

Key Data Fields

Reason Code

Bank-issued reason code explaining why the chargeback was filed, such as fraud, authorization, or processing errors.

Chargeback Amount

Total financial impact including the disputed transaction amount and any associated fees or penalties.

Filing Date

When the chargeback was initiated by the customer’s bank, establishing timelines for response requirements.

Reply By Date

Critical deadline for submitting representation evidence if you choose to dispute the chargeback.

spacer

Status Details

Current state of the chargeback including whether it’s resolved, under review, or awaiting representation.

Can Represent

Whether you have the option to submit evidence to dispute the chargeback decision.

Related Orders

Complete order details including products involved, order amounts, and transaction information.

Chargeback Type

Classification of the dispute such as fraud, authorization failure, or merchant processing error.

Amazon’s Chargebacks Report

Available at:

Seller Central → Performance → Chargebacks

Recommended Monitoring Frequency & Actions

How Often to Check This Report

Weekly Monitoring

Check chargebacks weekly as they typically have 7-14 day response windows. Missing response deadlines forfeits your right to dispute invalid chargebacks.

High-Risk Businesses

Sellers in categories prone to chargebacks (electronics, jewelry, supplements) should monitor 2-3 times per week to ensure no deadlines are missed.

Required Actions Based on Report Data

- Submit Representation Evidence

Provide transaction records, shipping confirmation, and customer communications within deadline - Analyze Chargeback Patterns

Identify recurring reason codes to address systemic payment or fulfillment issues - Update Fraud Prevention

Implement additional verification for high-risk transactions and payment methods - Improve Transaction Descriptors

Ensure payment statements clearly identify your business to reduce confusion - Enhance Customer Service

Address customer issues proactively to prevent disputes from escalating - Document Response Processes

Build templates and workflows for faster chargeback dispute responses

Automate Your Chargeback Monitoring with Cajari

Cajari automatically collects this Chargebacks Report from your Amazon Seller Central account and delivers structured data to your systems through API endpoints or webhooks. Our platform handles the complex authentication and navigation, then provides detailed chargeback information that integrates seamlessly with your payment processing tools, fraud prevention systems, and financial dashboards.

Stop manually checking for new chargebacks and start responding to payment disputes faster with automated alerts and deadline tracking.

Book a personalized demo with our team and discover how we can transform your agency’s workflow.

Have questions or need support? Our team is here to help with onboarding, technical issues, and any inquiries about Cajari.